SCHD Stock Overview

Blog

Diversify Your Portfolio with SCHD Stock: A Comprehensive Guide

Are you looking to add a dividend-focused investment to your portfolio? Look no further than the Schwab US Dividend Equity ETF, commonly referred to as SCHD stock. As one of the most popular dividend ETFs on the market, SCHD provides investors with a diversified portfolio of high-quality dividend-paying stocks.

Are you looking to add a dividend-focused investment to your portfolio? Look no further than the Schwab US Dividend Equity ETF, commonly referred to as SCHD stock. As one of the most popular dividend ETFs on the market, SCHD provides investors with a diversified portfolio of high-quality dividend-paying stocks.

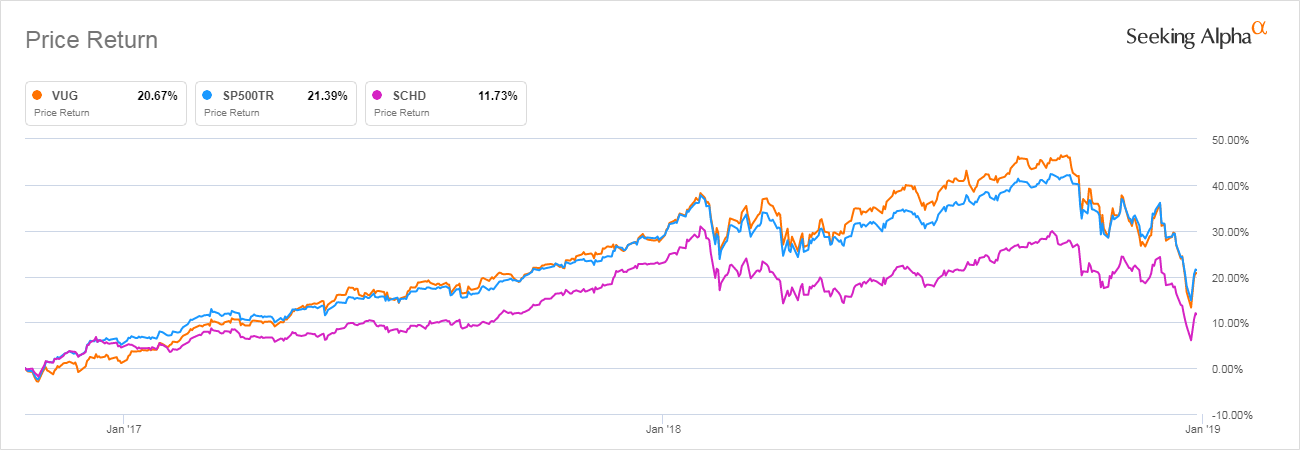

SCHD is an exchange-traded fund (ETF) that tracks the Dow Jones US Dividend 100 Index. This index is composed of the top 100 dividend-paying stocks in the US market, with a focus on quality and sustainability. The ETF uses a rules-based approach to select its holdings, ensuring that investors receive a consistent stream of income.

SCHD is an exchange-traded fund (ETF) that tracks the Dow Jones US Dividend 100 Index. This index is composed of the top 100 dividend-paying stocks in the US market, with a focus on quality and sustainability. The ETF uses a rules-based approach to select its holdings, ensuring that investors receive a consistent stream of income.

Investing in SCHD stock offers several benefits for investors:

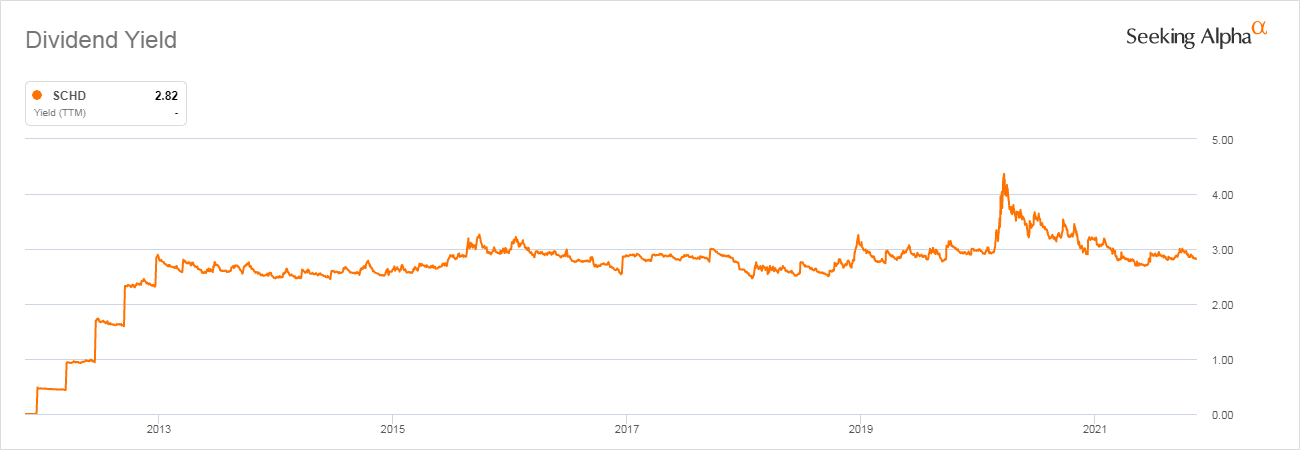

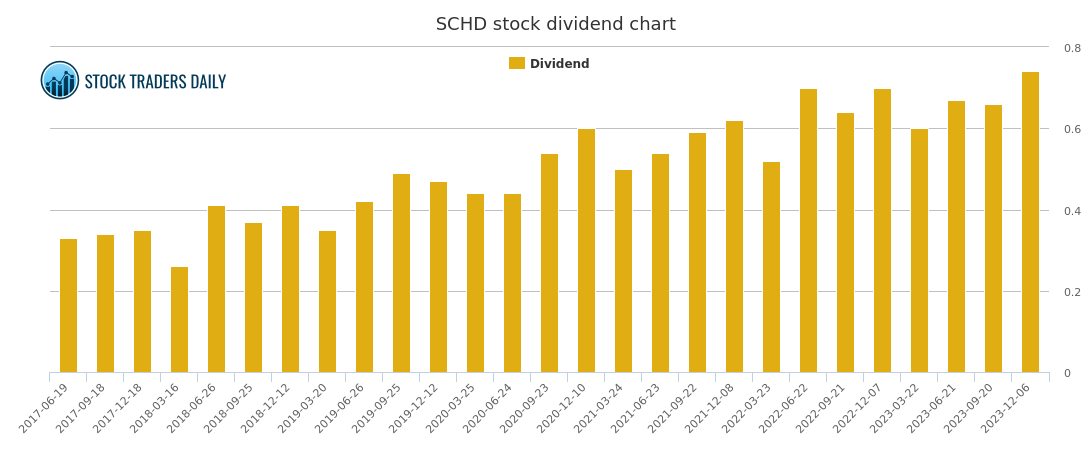

Income Generation: With a focus on dividend-paying stocks, SCHD provides investors with a regular source of income.

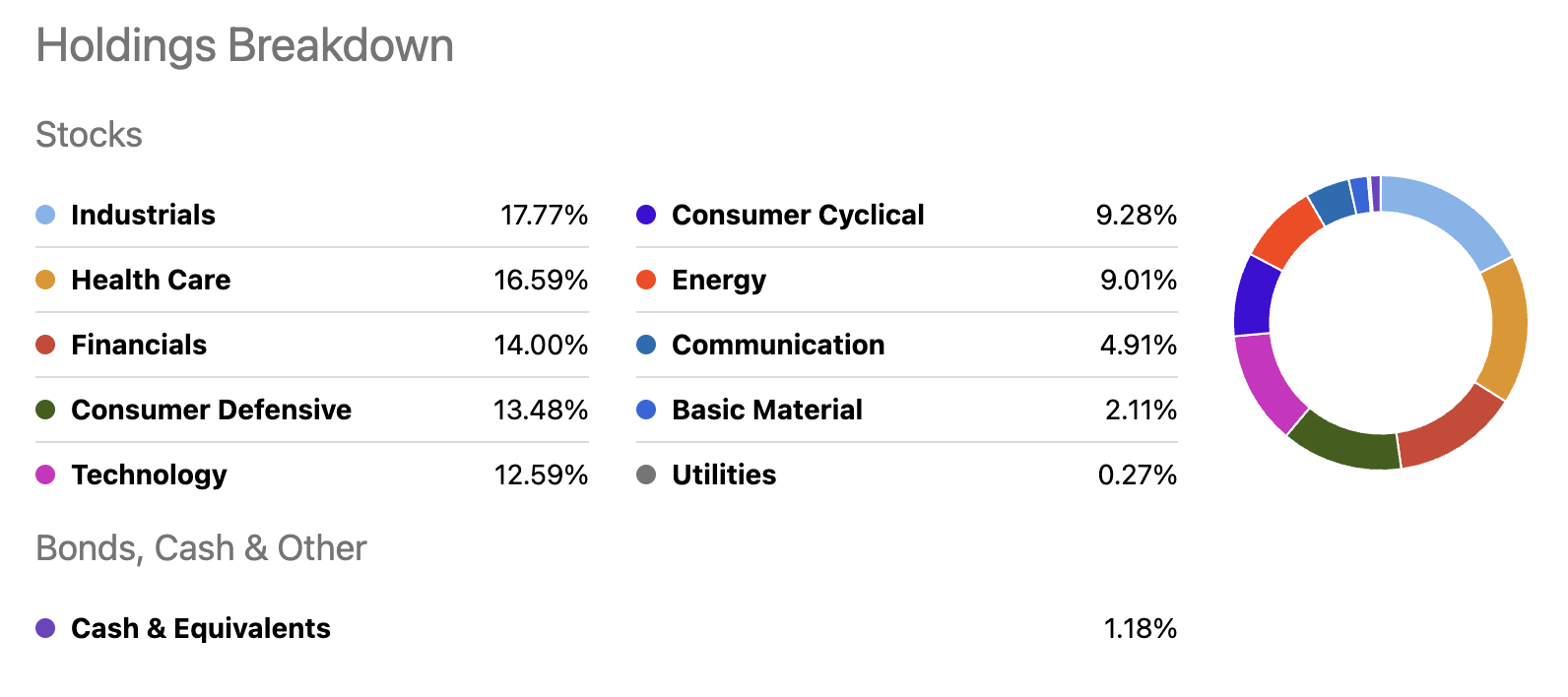

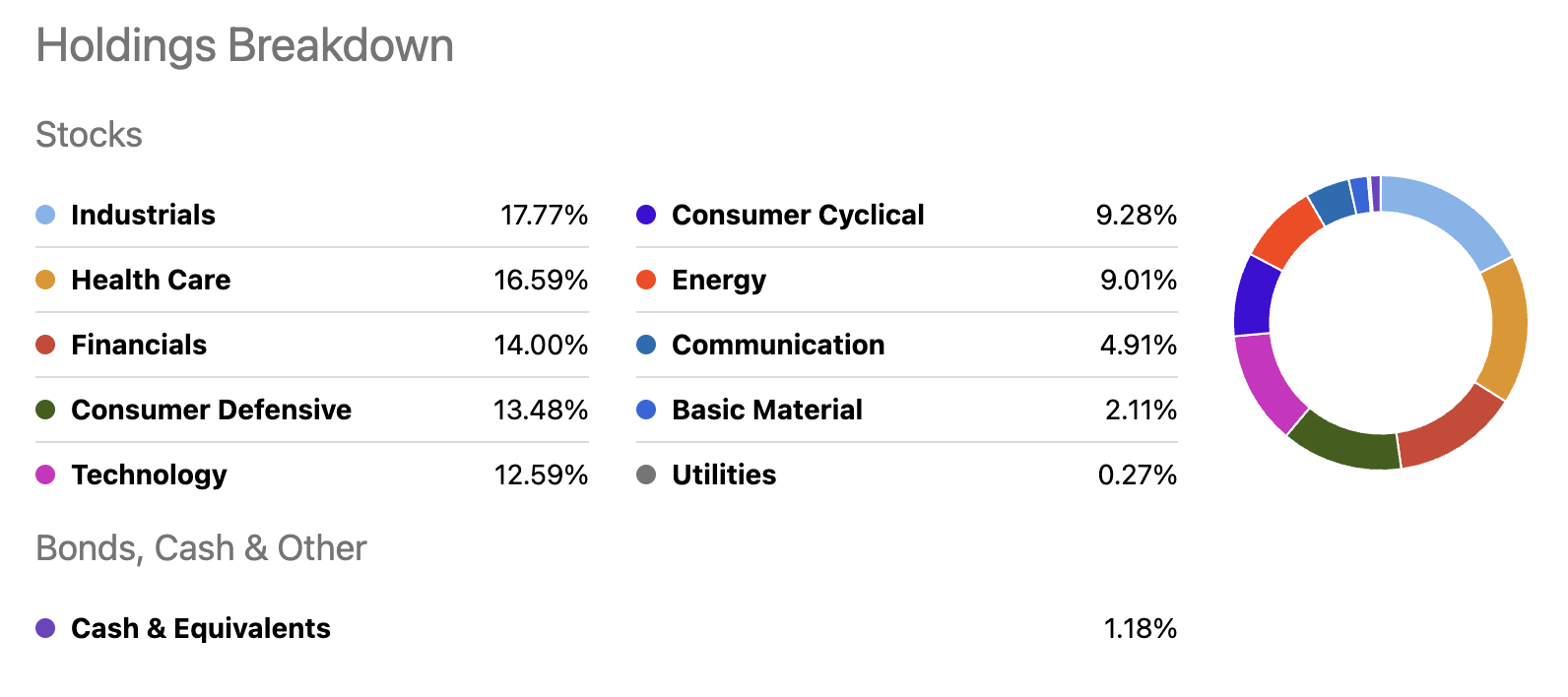

Portfolio Diversification: By investing in a diversified portfolio of high-quality dividend stocks, investors can reduce their exposure to individual stocks and sectors.

Low Cost: As an ETF, SCHD has a low expense ratio compared to actively managed funds.

Transparency: With its rules-based approach, investors have complete transparency into the selection process for SCHD's holdings.

Investing in SCHD stock offers several benefits for investors:

Income Generation: With a focus on dividend-paying stocks, SCHD provides investors with a regular source of income.

Portfolio Diversification: By investing in a diversified portfolio of high-quality dividend stocks, investors can reduce their exposure to individual stocks and sectors.

Low Cost: As an ETF, SCHD has a low expense ratio compared to actively managed funds.

Transparency: With its rules-based approach, investors have complete transparency into the selection process for SCHD's holdings.

Table of Contents

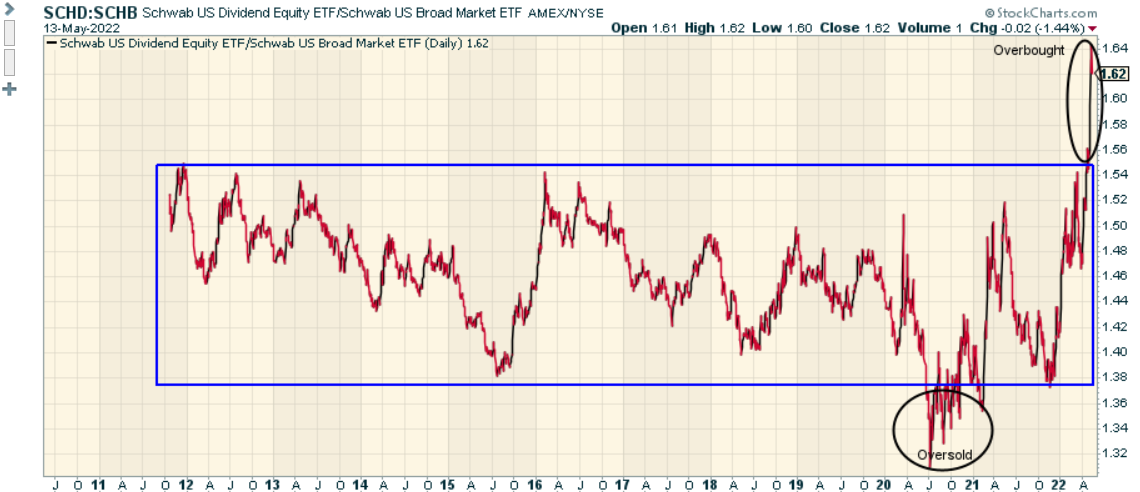

- SCHD ETF stock: is the return of the raging bull in sight?

- Schd Next Ex Dividend Date 2025 - Addy Crystie

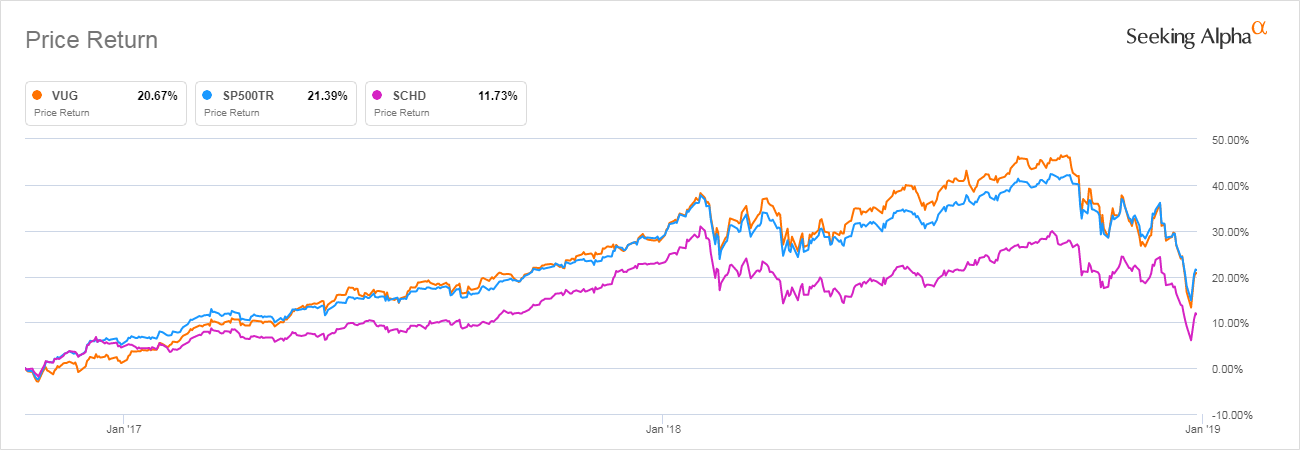

- SCHD: Wait For A Lower Entry Point To Own This Stellar ETF | Seeking Alpha

- SHOULD I PUT IT ALL IN SCHD? (& Sell My Individual Dividend Stocks ...

- SCHD and JEPI: 2 Dividend ETFs To Consider | Nasdaq

- This Dividend ETF Can be a Cornerstone of Your Portfolio

- Schwab SCHD: Rising Rates Will Severely Damage ETF Price | Seeking Alpha

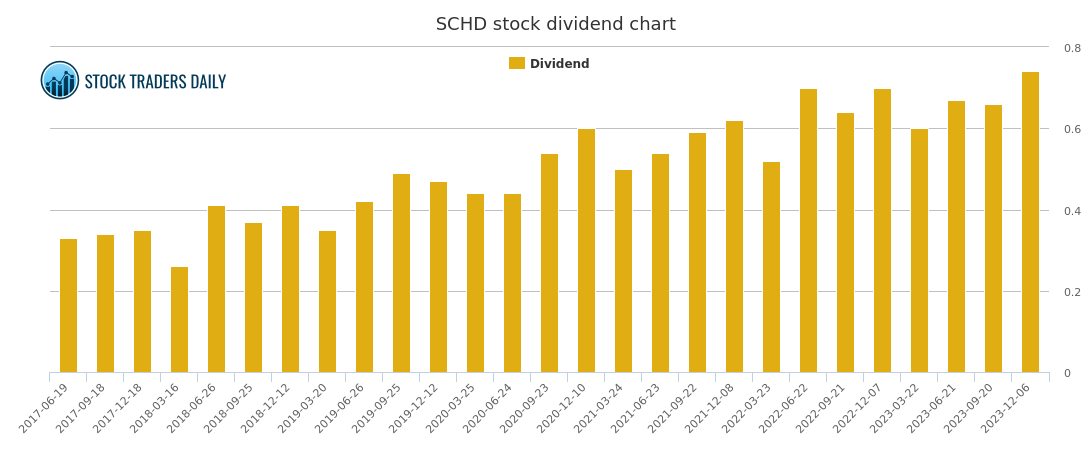

- SCHWAB US DIVIDEND EQUITY ETF SCHD DIVIDEND CHART

- VOO vs SCHD: Which ETF is Better? — The Market Hustle

- SCHD: High Stock Valuations & Slow EPS Growth Flash A Warning | Seeking ...

What is SCHD Stock?

Why Invest in SCHD Stock?

How Does SCHD Stock Work?

SCHD works by tracking the performance of the Dow Jones US Dividend 100 Index. The ETF holds a portfolio of stocks that are selected based on their dividend yield and sustainability. The selection criteria include: Dividend Yield: Stocks with a high dividend yield are more likely to be included in the portfolio. Sustainability: Companies with strong financials, low debt-to-equity ratios, and a history of paying consistent dividends are given preference.